rhode island tax table 2019

Tax rate of 375 on the first 65250 of taxable income. Schedule M - Rhode Island Modifications to Federal AGI.

Rhode Island Division Of Taxation 2019

The steps in computing the income tax to be withheld are as follows.

. The income tax withholding for the State of Rhode Island includes the following changes. Find your pretax deductions including 401K flexible account contributions. The Rhode Island State Tax Tables for 2018 displayed on this page are provided in support of the 2018 US Tax Calculator and the dedicated 2018 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Assuming you filed a nonresident Rhode Island Form RI-1040 last year you will find the total tax on page 1 line 8 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet. Applied to formulas under Rhode Island General Laws 44-30-26. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket.

Schedule U - Individual Consumers Use Tax. Find your pretax deductions including 401K flexible account contributions. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1.

Discover Helpful Information and Resources on Taxes From AARP. There is no applicable county tax city tax or special tax. Printable Rhode Island state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

However if a taxpayers federal. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly. Rhode Island personal and dependency exemption amounts by tax year 2019 2020 4100 4150 Most taxpayers are able to claim the full amount of their applicable standard deduction.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government. The sales tax jurisdiction name is South Kingstown which may refer to a local government division. If you prepared your tax return using TurboTax last year you can log into your account to access your 2019 income tax returns and obtain the amount from the forms.

The modification first The modification first appeared on Division of Taxation forms in early 2018 covering the 2017 tax year. 2019 Social Security Worksheet for line 1u of RI Schedule M. Rhode Island Tax Table 2019 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1000 0 3 5 7 8 10 12 14 16 18 20 22 23 25 27 29 31 33 35 37 2400 2450 2500 2550 2600 2650 2700 2750 2800 2850 2900 2950 2050 2100 2150 2200 2450.

Find your income exemptions. Of the on amount Over But Not Over Pay Excess over 0 66200. Rhode Island state income tax Form RI-1040 must be postmarked by April 18 2022 in order to avoid penalties and late fees.

Find your income exemptions. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The annualized wage threshold where the annual exemption amount is eliminated has increased from 221800 to 227050.

The Rhode Island Department of Revenue is responsible for. The Rhode Island State Tax Tables for 2016 displayed on this page are provided in support of the 2016 US Tax Calculator and the dedicated 2016 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. For married taxpayers living and working in the state of Rhode Island.

Schedule CR - Other Rhode Island Credits. 1 See Rhode Island Public Law 2016 ch. 13 16 codified at Rhode Island General Laws 44-30-12.

Find your gross income. Finally we add 8809 to the base taxes 70800 to get a total Rhode Island estate tax burden of 79609 on a 32 million estate. The annual taxable wage table has changed.

The Rhode Island Department of Revenue is responsible for. Levels of taxable income. The Rhode Island State Tax Tables for 2017 displayed on this page are provided in support of the 2017 US Tax Calculator and the dedicated 2017 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table. Pay Period 03 2019. The Rhode Island Department of Revenue is responsible for.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of. Your 2021 Tax Bracket to See Whats Been Adjusted. Check the 2019 Rhode Island state tax rate and the rules to calculate state income tax.

The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. That sum 122344 multiplied by the marginal rate of 72 is 8809. Tax rate of 375 on the first 65250 of taxable income.

Rhode Island annual income tax withholding tables percentage method for wages paid on or after January 1 2019. Tax rate of 475 on taxable income between 65251 and 148350. The Rhode Island State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. The 2019 Form RI W-4 which the employer is required to keep on file is included in the 2019 employer withholding booklet and available separately here. Find your gross income.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. Its 400 Rhode Island filing fee is due March 15 2019. No action on the part of the employee or the personnel.

RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1 mb megabytes RI-1040NR 2021 Nonresident Individual Income. The following table shows the March filing deadline and September extended due date for a number of business entities and tax types. Ad Compare Your 2022 Tax Bracket vs.

The Rhode Island Department of Revenue is responsible for. The same is true for personal exemptions and dependency exemptions. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax.

Tax rate of 599 on taxable income over 148350. The 7 sales tax rate in Kingston consists of 7 Rhode Island state sales tax. DO NOT use to figure your Rhode Island tax.

Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. The Rhode Island Department of Revenue is responsible for. 2019 Tax Rate Schedule.

You can print a 7 sales tax table here.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Division Of Taxation 2019

Solved I M Being Asked For Prior Year Rhode Island Tax

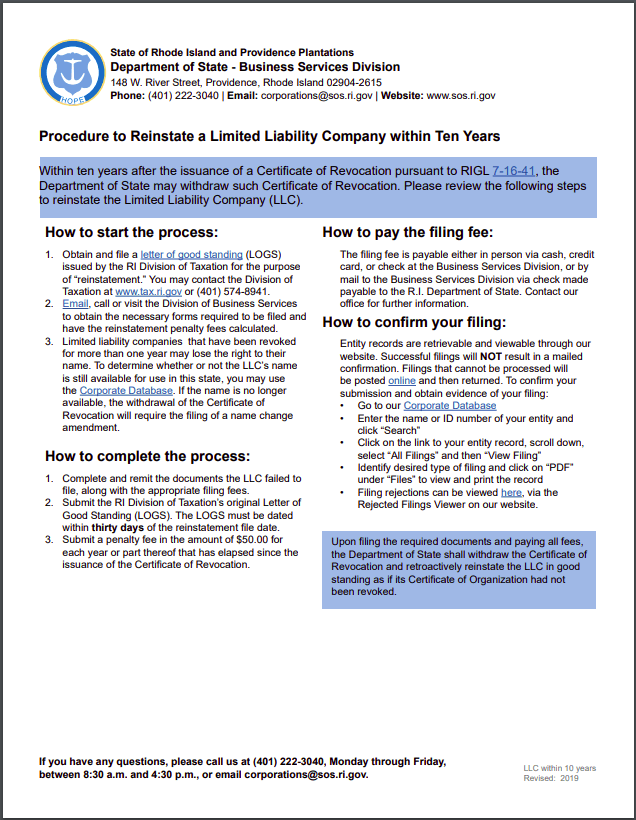

Free Guide To Reinstate Or Revive A Rhode Island Limited Liability Company

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Kentucky Income Tax Rate And Brackets 2019

Rhode Island Income Tax Brackets 2020

Individual Income Tax Structures In Selected States The Civic Federation

Rhode Island Division Of Taxation 2019

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Division Of Taxation 2019